The Economics of Polkadot

How to use the slides - Full screen (new tab)

The Economics of Polkadot

Overview

- Which economic pieces build the the Polkadot Network?

- What are their mechanisms and incentives?

- How are those pieces interrelated?

Remark: There are currently many changes planned

Token Economics

DOT Token

- Native token of the Polkadot network.

- 1 DOT = \(1\mathrm{e}{10}\) Plancks

-

Planck = smallest unit of account.

- Reference to Planck Length = the smallest possible distance in Physics.

-

Utility Token with several use-cases:

- Governance (decentralization)

- Bonding in slot auctions (utility)

- Staking (security)

- Message passing (e.g., transfers)

Inflation Model

- Expansion in token supply.

- Token minted from thin air.

- Used to pay staking rewards for validators and nominators.

- (Indirectly) fund Treasury.

- Central economic variables of the model are:

- Exogenous:

- Staking rate (Total amount of staked DOT / Total amount of DOT).

- Endogenous:

- Optimal staking rate (a sufficient backing for validators to provide reasonable security).

- Total inflation rate (10%).

Inflation Model

- Different states of DOT:

- Liquid: Used for messaging and liquidity on markets.

- Bonded (Staking): Economic mass that guarantees the security of the network.

- Bonded (Parachains): The demand for DOT tokens by parachains.

- The goal is to obtain (some) sensible ratio between those three token states.

Inflation Model

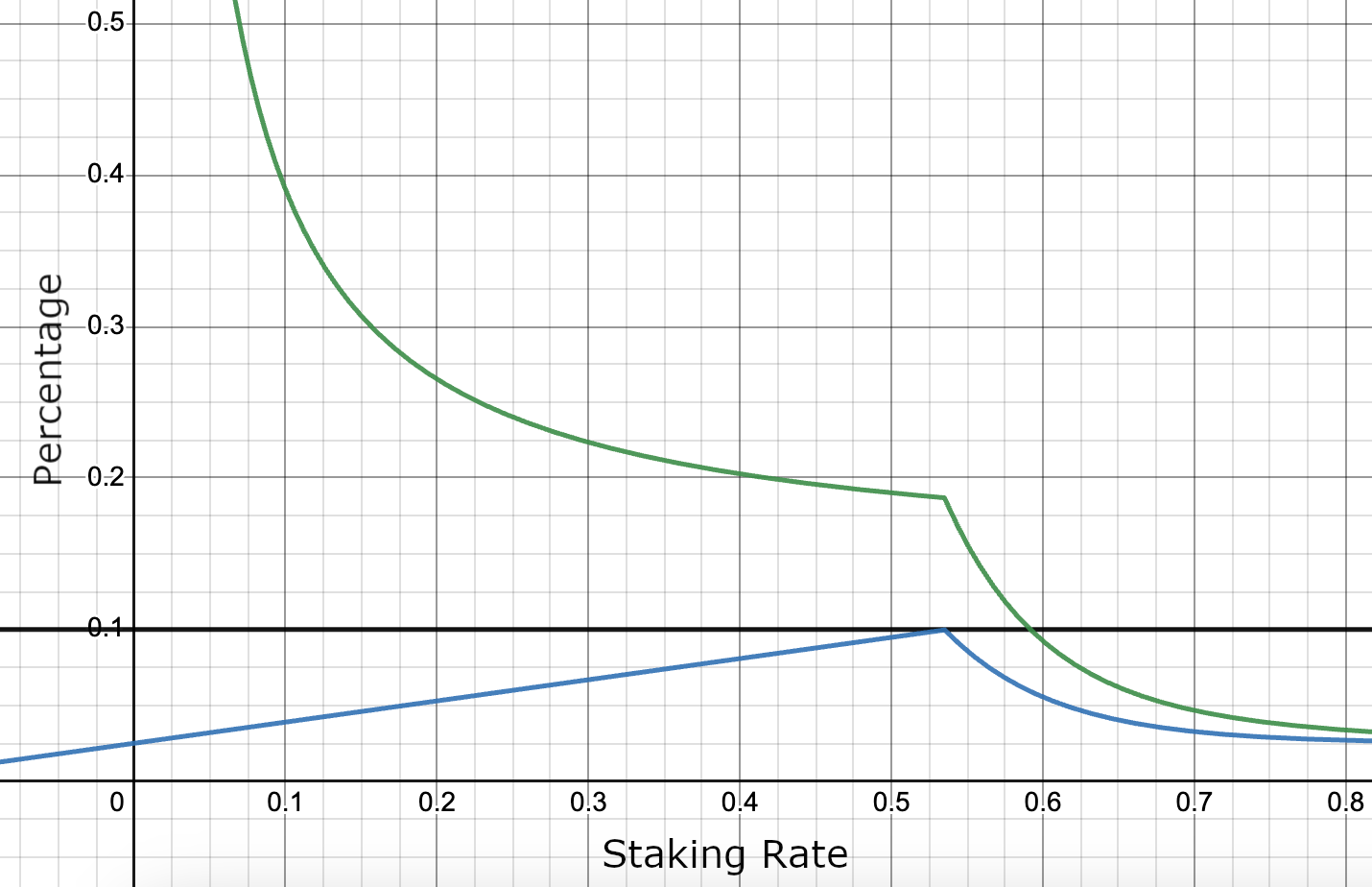

- Central variable: Ideal staking rate (currently ~53.5%).

- Highest staking rewards at the ideal staking rate.

- Incentives to (increase) decrease the staking rate it is (below) above the optimal.

- Staking inefficiencies -> Treasury.

- Ideal staking rate scales with number of active parachains (0.5% less with each parachain).

Inflation

- In the fiat-world, inflation has a negative connotation.

- This is a general discussion in economics.

- My take on this:

- Predictable (maximum) inflation is good.

- It incentivizes to work with the tokens (i.e., bond for good parachains, use for message passing).

- Deflation can cause a halt of economic activity, because people start hoarding tokens.

Notes:

Question: What do you think about Inflation?

Potential changes incoming

- The current system incentivizes to move the staking rate to the ideal rate.

- Then, Treasury inflow would be 0 DOT.

- That is not sustainable.

- Proposed change: Detach inflation to stakers from total inflation and divert the rest to Treasury directly.

Staking: Concept

- Nominated Proof-Of-Stake (NPoS).

- Economic incentives of validators and nominators are aligned with those of the network.

- Good behavior is rewarded with staking rewards.

- Malicious / Neglecting behavior is punished (slashed).

- Currently, minimum total stake is ~1.6M DOTs.

- The total stake in the system directly translates to the economic security that it provides.

- Total stake is pooled from validators (self-stake) and their nominators (nominated stake)

- High degree of inclusion

- High security

- The goal is to get as much skin-in-the-game as possible.

Validators

- What makes Validators resilient:

- Self-stake

- Reputation (identity)

- High future rewards (self-stake + commission)

Nominators

- Bond tokens for up to 16 validators that they deem trustworthy.

- They have an incentive to find the best ones that match their preferences.

- They are tasked to collectively curate the set of active validators.

Rewards

- What are staking rewards for?

- Validators: Hardware, networking, and maintenance costs, resilience.

- Nominators: Curation of the active set of validators, sort out the good from the bad ones (Invisible Hand).

Validator Selection

- The job of nominators is to find and select suitable validators.

- Nominators face several trade-offs when selecting validators:

- Security, Performance, Decentralization

- Ideally those variables in their historic time-series.

- Economic Background:

- Self-stake as main indicator of skin-in-the-game.

- Higher commission, ceteris paribus, leaves a validator with more incentives to behave.

- Various sources of trust

- Efficient validator recommendation is one of my research topics.

Parachains

What are Parachains?

- Parachains (or cores) are the layer-1 part of the protocol.

- Blockchains of their own that run in parallel.

- Highly domain specific and have high degree of flexibility in their architecture.

- Share same messaging standard to be interoperable and exchange messages through the Relay Chain.

- Polkadot: 43 Parachains, Kusama: 46 Parachains.

- Their state transition function (STF) is registered on the Relay Chain.

- Validators can validate state transitions without knowing all the data on the Parachain.

- Collators keep the parachain alive (but are not needed for security).

- Offer their utility to the network.

Parachain Slots

- The access to the network is abstracted into the notion of “slots”.

- Leases for ~2 years on Polkadot (~1 year on Kusama).

- Only limited amount of slots available (networking).

- The slots are allocated through a candle auction.

- Bonded tokens held (trustlessly) in custody on the Relay Chain.

- The tokens will be refunded after the slot expires.

Economic Intuition

- Tokens cannot be used for anything (staking, transacting, liquidity, governance).

- That means, tokens locked cause opportunity costs.

- An approximation is the trust-free rate of return from staking.

- Parachains need to compete with those costs and generate benefits that exceed those opportunity costs.

- Sufficient crowdloan rewards.

- Sufficient economic activity on-chain that justifies renewal.

- Slot mechanism creates constant demand for DOT token.

- It is costly to be and remain a parachain.

- Natural selection mechanism to select useful parachains.

- Continuous pressure to gather funds for extending slots.

What do Parachains get?

- Parachains pay for security.

- Every parachain is as secure as the Relay Chain.

- Polkadot is a security alliance with network effects.

- Not only scaling number of transactions, but it also scaling of security.

- Security is a pie of limited size, because financial resources are limited.

- Every chain that secures itself need cut a piece of the cake, which leaves less to others (zero-sum).

- Shared security protocols allow to keep the cake whole and entail it to all participants.

- Shared security is a scaling device, because the amount of stake you need to pay stakers to secure 100 shards is less than you need to pay stakers to secure 100 individual chains.

Outlook Polkadot 2.0

- Based on Gav’s Keynote at Polkadot Decoded 2023.

- A new narrative of the whole Polkadot system.

- We move away from regarding Parachains as a distinct entity but rather regard Polkadot as global distributed computer.

- It's spaces and apps rather than chains.

- This computer has computation cores that can be allocated flexible to applications that need it.

- Coretime can be bought, shared, resold.

Core Attributes of Blockspace

- Security: The scarcest resource in blockchain, crucial in preventing consensus faults or 51% attacks that could compromise transactions.

- Availability: Ensuring blockspace is available without long waiting times or uncertain costs for a smooth, seamless interaction within the decentralized ecosystem.

- Flexibility: The ability of blockspace to be fine-tuned by the consumer for specific use-cases.

Blockspace Ecosystem

- A networked collection of individual blockspace producers (blockchains) offering secured, fit-for-purpose, efficiently-allocated, and cost-effective blockspace.

- A valuable aspect of a blockspace ecosystem is its connective tissue of shared security and composability.

- Dapp developers or blockspace providers can focus on their unique features, reusing existing capabilities within the ecosystem.

- For example, a supply chain traceability application could use different types of blockspace for identity verification, asset tokenization, and source traceability.

Bulk markets

- It's not yet finalized how they work but likely:

- Around 75% of cores are allocated to the market.

- Cores are sold for 4 weeks as NFT by a broker.

- Unrented cores go to the instantaneous market.

- Price de-/increases relative to demand.

- Current tenants have a priority buy right for their core(s).

Why the change?

- This allows for low barriers of entry for people to simply deploy their code to a core and test stuff

- It makes blockspace more efficient, because not all teams can/want to have a full block every 6/12 seconds.

Treasury

- The treasury is an on-chain fund that holds DOT token and is governed by all token holders of the network.

- Those funds come from:

- Transactions

- Slashes

- Staking inefficiencies (deviations from optimal staking rate)

- Through governance, everybody can submit proposals to initiate treasury spending.

- It currently holds around 46M DOT.

- Spending is incentivized by a burn mechanism (1% every 26 days).

Treasury as DAO

- A DAO (decentralized autonomous organization) that has access to funds and can make funding decisions directed by the collective (that have vested interest in the network).

- This has huge potential that might not yet have been fully recognized by the people.

- This provides the chain the power to fund its own existence and improves the utility in the future. It will pay…

- … core developers to improve the protocol.

- … researchers to explore new directions, solve problems and conduct studies that are beneficial for the network.

- … for campaigns educating people about the protocol.

- … for systems-parachains (development & collators).

- A truly decentralized and self-sustaining organization.

How does it all fit together?

Takeaways

- Polkadot is a system that offers shared security and cross-chain messaging.

- Security scales, i.e., it takes less stake to secure 100 parachains than 100 individual chains.

- The DOT token captures the utility that the parachains provide and converts it to security.

- The slot mechanics (renewal, auctions) creates a market where parachains need to outcompete opportunity costs to be sustainable (i.e., they need to be useful).

- Polkadot is a DAO that will be able to fund its own preservation and evolution.

- There are many changes to come with Polkadot 2.0 creating a much more agile system.